Europe’s online retail market is enormous and still accelerating. In 2023 European e-commerce reached about $708 billion and is projected to climb to nearly $900 billion by 2028. This region’s online sales make up only about half of its retail potential, leaving plenty of untapped demand. In other words, “the European e-commerce opportunity” is real. By comparison, the U.S. e-commerce market (over $1 trillion) is bigger, but also far more mature and crowded. Sellers focusing only on Amazon US risk missing out on Europe’s high-growth markets.

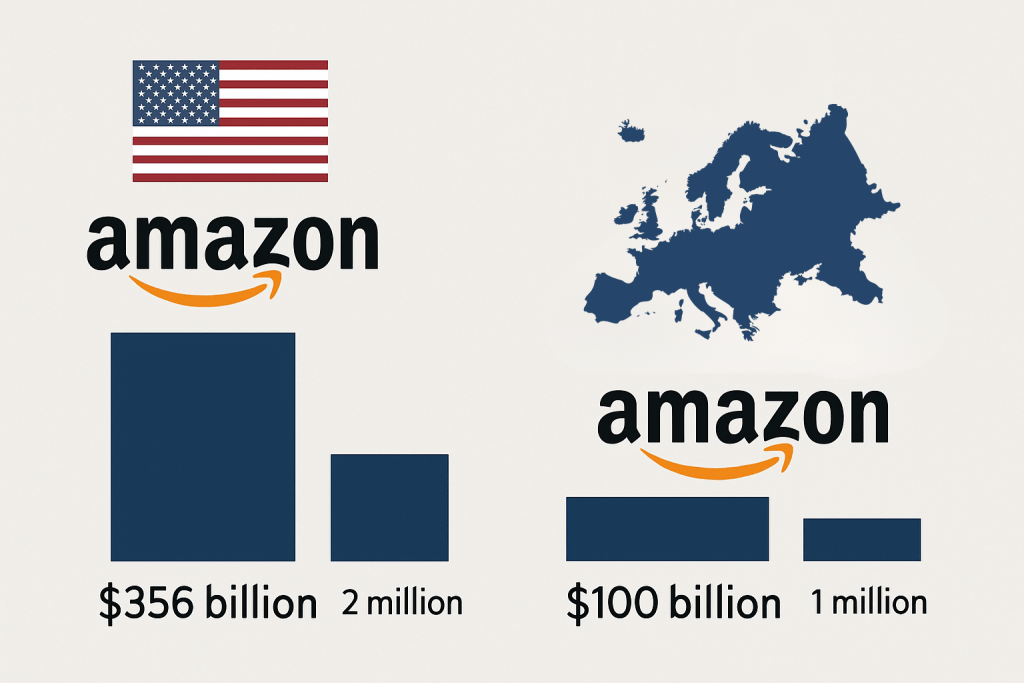

Amazon US vs. European Marketplaces

Amazon’s U.S. marketplace is massive – roughly $356 billion in sales (2023) – but extremely competitive, with over 2 million sellers. Amazon’s combined European marketplaces (UK, Germany, France, Italy, Spain) generated about $100 billion in 2022, but with only around 1 million sellers total. In practice, this means many product categories (home goods, pets, etc.) are less saturated in Europe. Sellers with a strong foothold in the U.S. can often “carve out space” in Europe with fewer rivals and less aggressive price competition.

Moreover, Amazon’s dominance varies by country. For example, in France Amazon holds only about twice the share of its nearest domestic competitor (around 70% of top French e-commerce sites are local businesses). In Spain, Amazon.es reaches roughly 90% of online shoppers, making it dominant but leaving a still-sizeable market for national platforms. In Italy, over 31 million people shop online and spent about €45 billion in 2022; Amazon.it leads, but specialized and local retailers are very active. In short, selling in Europe is not “one Amazon” – it’s many country-specific marketplaces, each with its own dynamic.

Europe’s fashion leader Zalando (above) started as a local German platform and now serves customers across multiple countries. Likewise, localized marketplaces in France, Spain and Italy have grown large by catering to regional preferences. For instance, only about one-third of French consumers ever shop on Amazon, and most top French retailers are domestic. Spanish and Italian buyers also use homegrown platforms (often retailer or niche sites) alongside Amazon. These local marketplaces tap into national buying habits and loyal audiences, so they unlock customer pools that global giants can’t fully reach.

Benefits of Regional Marketplaces

Selling through European regional platforms brings clear advantages over relying solely on Amazon US:

- Reduced Competition: Europe’s marketplaces generally have far fewer sellers than the US. For example, the entire Amazon EU network hosts ~1 million sellers versus ~2 million in the US. This lower density means less crowded search pages and more opportunity to stand out.

- Targeted Audiences: Local marketplaces cater to specific demographics and shopping behaviors. Platforms in France, Spain or Italy have focused audiences and well-known peak seasons. ChannelEngine notes that regional sites are “much easier to target precisely” because they know their customer niches.

- Localized Expertise: Country-specific sites already understand local habits – from preferred payment methods to language nuances. European marketplaces and Amazon’s EU sites require listings in native languages, and local platforms accumulate deep knowledge of what each market wants. This means you can often set your own prices and messaging to match local tastes.

- Loyal Customer Bases: Many European shoppers exhibit loyalty to homegrown brands. ChannelEngine observes that local platforms have established pools of customers who “frequently avoid” the big global sites. By selling on these sites, you tap into repeat buyers and word-of-mouth in each region.

- Higher Margins Potential: With less discount pressure and fewer low-cost competitors, sellers often enjoy healthier margins. (In practice, sellers often report that early success in a regional market can yield higher ROI than the highly commoditized US Amazon market.)

Each of these factors makes Europe a viable Amazon US alternative. Many European marketplaces (including emerging ones) even invest heavily in marketing to sellers. For example, the new platform Temu now operates in multiple EU countries and “offers sellers early-stage growth with less competition”. Similarly, bol.com (in Benelux) and other regional champions provide integrated logistics and advertising for foreign sellers, easing entry.

Diversify Beyond Amazon US

Relying solely on Amazon US is risky. Recent trade uncertainties and tariffs have shown that the U.S. market can change unexpectedly. Payoneer reports that the “US market isn’t the same safe bet it once was,” and selling beyond the US is a way to regain control and reduce risk. Expanding into Europe (with over 500 million consumers and booming online sales) diversifies your revenue and shields you from any one region’s volatility.

Capturing growth in Europe also means new sales channels. Amazon’s Pan-European FBA program makes it easier to ship and distribute across borders once you’re set up. And as you sell into different countries, you boost brand recognition internationally. In practice, many top sellers now list on multiple Amazon EU marketplaces and local sites – studies find 46% of US Amazon sellers also sell abroad.

Don’t miss the European opportunity. By selling on localized marketplaces in France, Spain, Italy (and beyond), you tap into large, growing markets with less competition and often higher margins than the saturated US channel. European consumers value local language, quality, and service, so tailor your listings accordingly. In short, use Europe as an Amazon US alternative to capture untapped demand and international growth.

Conclusion: Seize the European E-commerce Opportunity

Europe’s fragmented but lucrative e-commerce landscape is a goldmine for expansion-minded sellers. Established platforms and new niche marketplaces offer diversified audiences and new growth paths. Compared to the hyper-competitive US Amazon, many EU markets still have room to grow. By listing on regional platforms, you gain access to loyal customers, cultural insights, and potentially higher profits. In today’s dynamic environment, “playing only on Amazon US” means you’re missing out on one of the world’s fastest-growing e-commerce regions. The time to act is now: expand into Europe and tap into this rising online market before your competitors do.